Build a Bot Portfolio

in Minutes

(funded-account friendly)

Choose from pre-configured settings, filter by goals, avoid conflicts automatically. Like a menu that won't let you order something that breaks the diet.

HOW IT WORKS

Three Steps to Your Portfolio

Pick a portfolio that fits funded rules. Builder = selection + constraints based on your funded account rules.

Choose Asset Type

Select your futures asset type, whether you want to trade big or small futures contracts.

Balance Your Goals

Balance profit potential vs drawdown tolerance vs win rate vs profit factor and more.

Build Portfolio

Get conflict-checked settings list ready to deploy quickly so they don't violate funded account rules.

FEATURES

What You Get

Everything you need to build a funded account compliant bot portfolios.

8 Fully Automated Trading Bots

Choose from 8 professionally designed trading bots.

300+ Pre-Configured Settings

Pre-tested configurations that meet funded account requirements.

Funded Account Rules Filters

Instantly filter out settings that violate your funded account rules

Save Bot Portfolio Templates

Save and reuse your portfolio configurations across multiple accounts.

4 Years

Backtesting Period for Pre-Configured Settings

100%

Funded Account Rule Compliant

BACKED BY DATA

Portfolio Builder

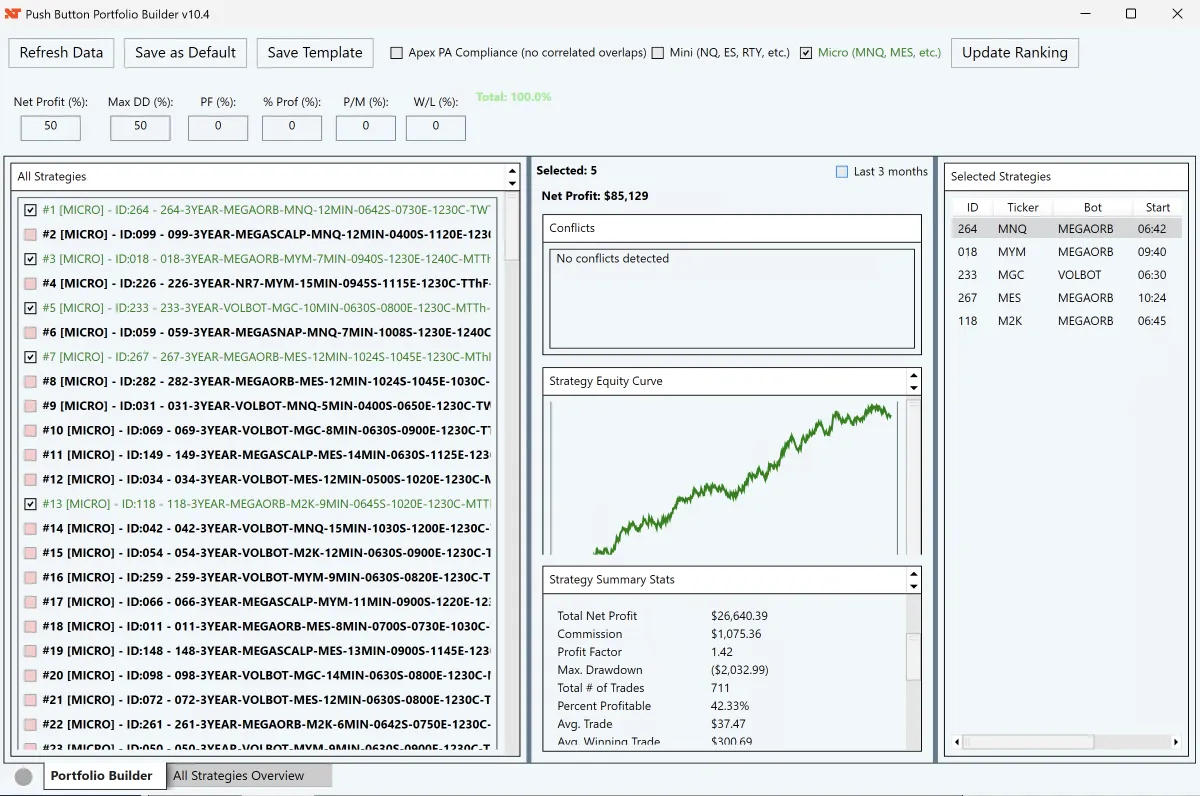

The Portfolio Builder lets traders build and evaluate a diversified automated bot portfolio using professional-grade analytics. It allows users to rank and select strategies based on key performance metrics, ensure prop-firm compliance, and avoid overlapping risk. The dashboard then displays a clear portfolio summary with equity curve, performance stats, and a snapshot of how strategies are distributed across markets and sessions.

© 2024 - 2026, Push Button Trading, All Rights Reserved

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonial Disclosure:

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Educational Disclosure:

The Push Button Trading mentorships, courses, classes, live events, and content are provided for educational purposes only. We are not providing financial advice. It is your responsibility to test all strategies and plans. You are the only one pushing the buttons and it is your responsibility to fully understand the risks before implementing any of the education provided by Push Button Trading.