Know what to expect before running your bot portfolio

Compare live performance to 4-year benchmarks, guard rails, and drawdown models. Know if your portfolio is behaving normally.

300+

Pre-Configured Settings

Tested & Optimized

87%

Pass Rate

Funded Accounts

$100

Avg Risk/Trade

Fixed Risk

20+

Account Scaling

Using Trade Copier

FUNDED ACCOUNT FOCUSED

Built for Funded Trading Accounts

Every feature designed around one goal: passing evaluations and scaling funded accounts.

Multiple Bot Portfolios

Test 3-9 bot settings as a portfolio to see how strategies perform together—not just individual bot performance.

Minimize Drawdown

Big profit means nothing if drawdown blows your funded account. We prioritize conistency over time, survival over hype.

Consistency Over Time

It's not about winning more—it's about controlling risk, even if profitable withlower win rates.

Fixed Risk Per Trade

Sort by risk to see $100-$1,000 per risk ranges. Match your portfolio to funded account, based on your account size.

Funded Account Rules

Apex 50K eval = $3K profit goal with ~$2.5K drawdown limit. Your portfolio must fit inside those guidelines.

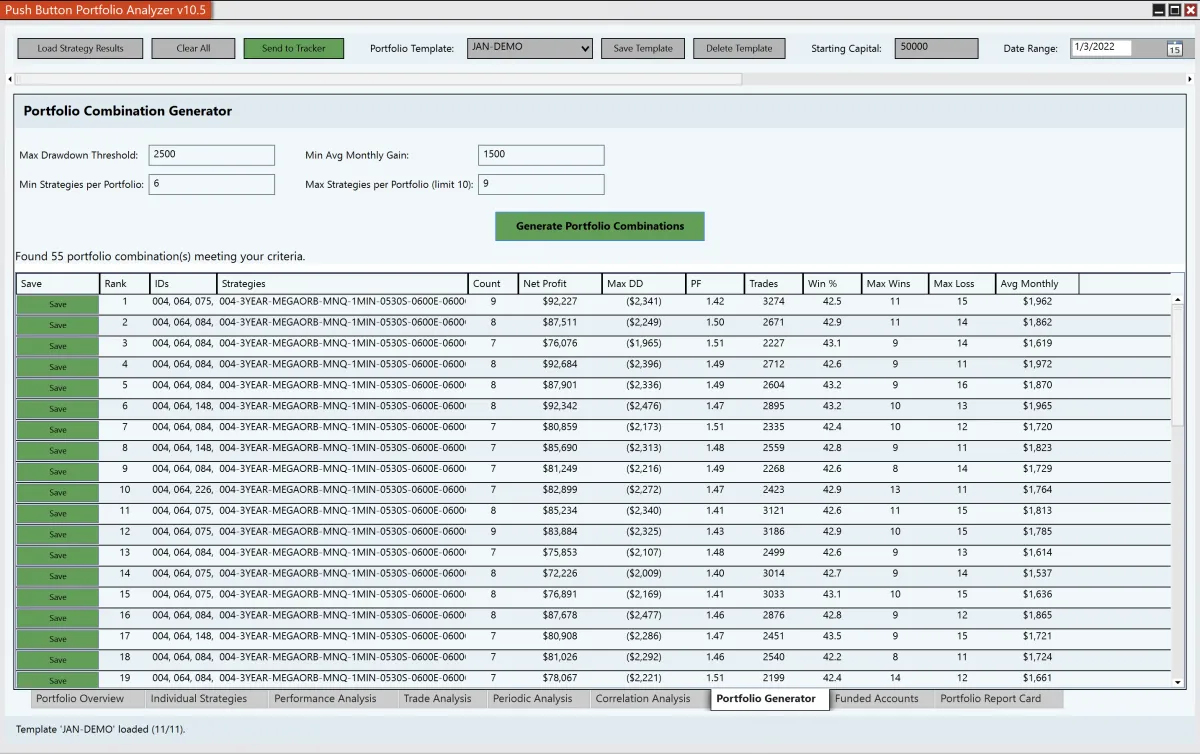

Portfolio Generator

The cheat code: Generate every 3-8 strategy combination and filter for your drawdown/profit targets.

HOW IT WORKS

Setup Portfolio in 4 Steps

From strategy selection to passing your evaluation in four clear steps.

01

Select Your Strategies

Choose from 300+ tested settings. Mix and match to build your initial portfolio candidates.

Access full library of pre-configured settings

View historical performance over 4 years

Compare risk profiles from hundreds to thousands of trades

02

Analyze as a Bot Portfolio

See how your selections work together. Combined portfolios behave differently from individual backtest results.

Combined drawdown analysis

Asset correlation checks

Risk distribution view

03

Comply with Funded Account Rules

Input your evaluation parameters: profit target, max drawdown, account size.

50K/100K/150K presets

Custom rule inputs

Pass probability score

04

Generate Optimal Combos

Use Portfolio Generator to find every combination that hits your targets. Filter by drawdown, profit, and more.

3 - 8 strategy combinations

Ranked by performance

Export ready settings

FUNDED ACCOUNT FOCUSED

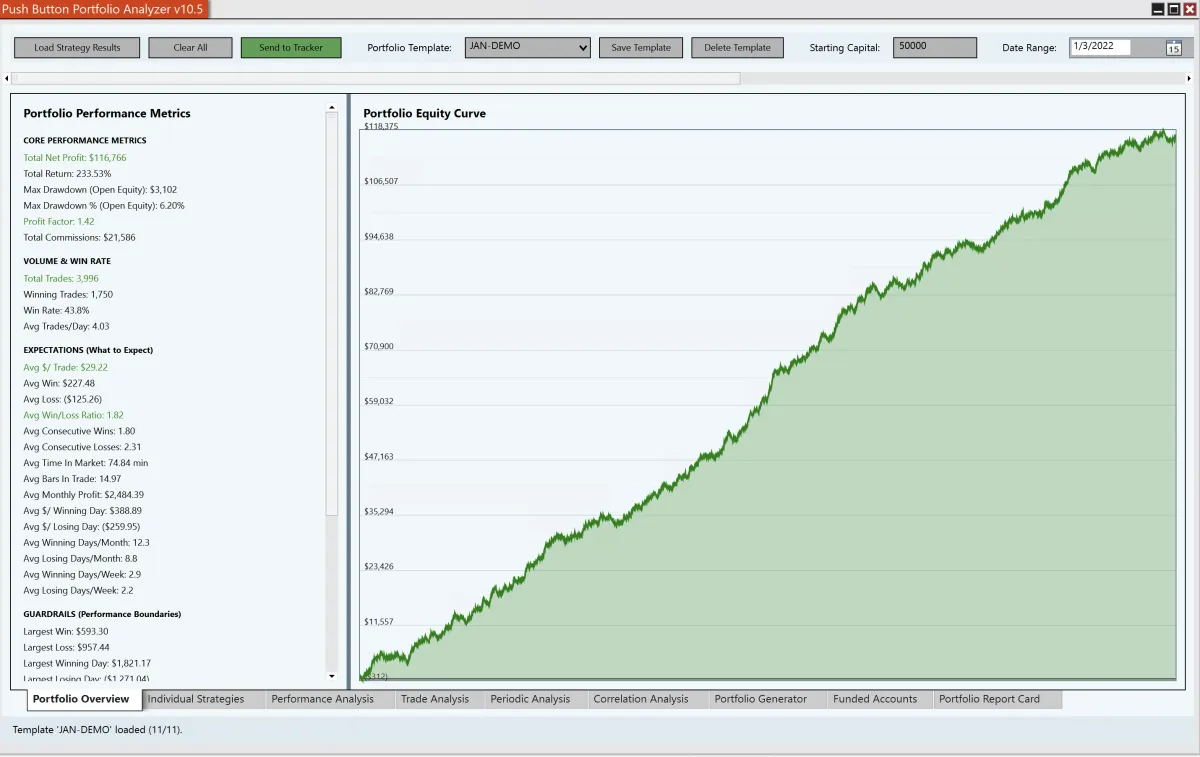

Portfolio Overview

This screen shows a real bot portfolio with clear performance metrics, drawdown numbers, and a steadily rising equity curve. It highlights how traders can quickly see pass-rate viability, risk boundaries, and consistency before deploying a portfolio to a funded account.

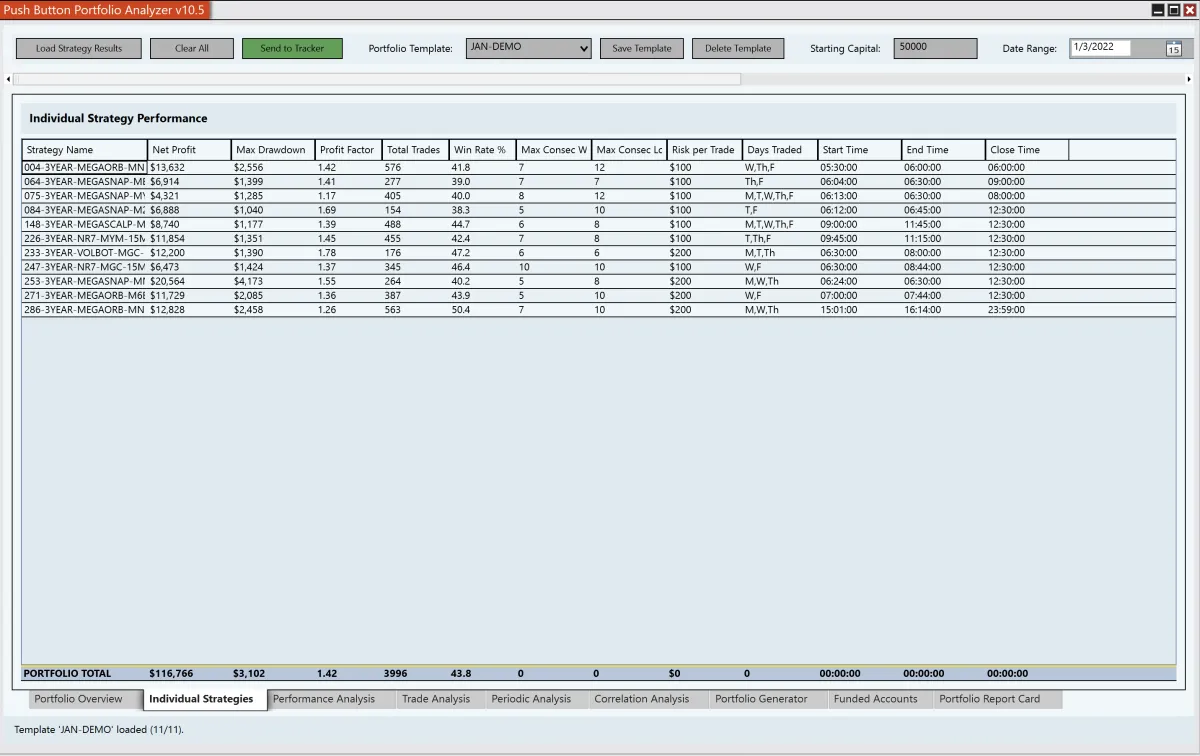

REVIEW SINGLE BOTS

Individual Strategies

This screen showcases the Individual Strategy Performance table, where each bot strategy is broken down by profit, drawdown, win rate, risk per trade, and trading timeframes. It lets traders instantly compare strategies, spot balance and diversification, and build funded-account-ready portfolios backed by data, not guesswork.

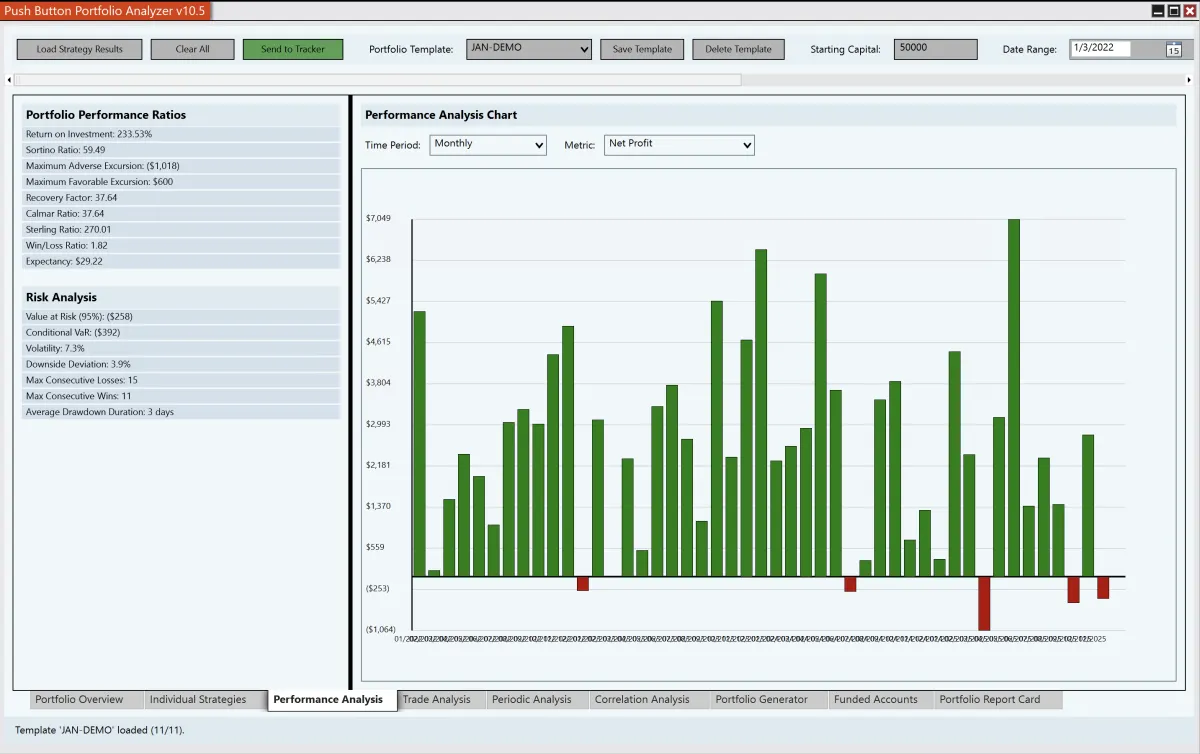

OVERALL PERFORMANCE

Performance Analysis

This screen highlights the Performance Analysis view, combining advanced ratios and risk metrics with a clear monthly profit breakdown. Traders can quickly spot consistency, downside risk, and drawdown behavior to verify whether a portfolio aligns with funded account rules before going live.

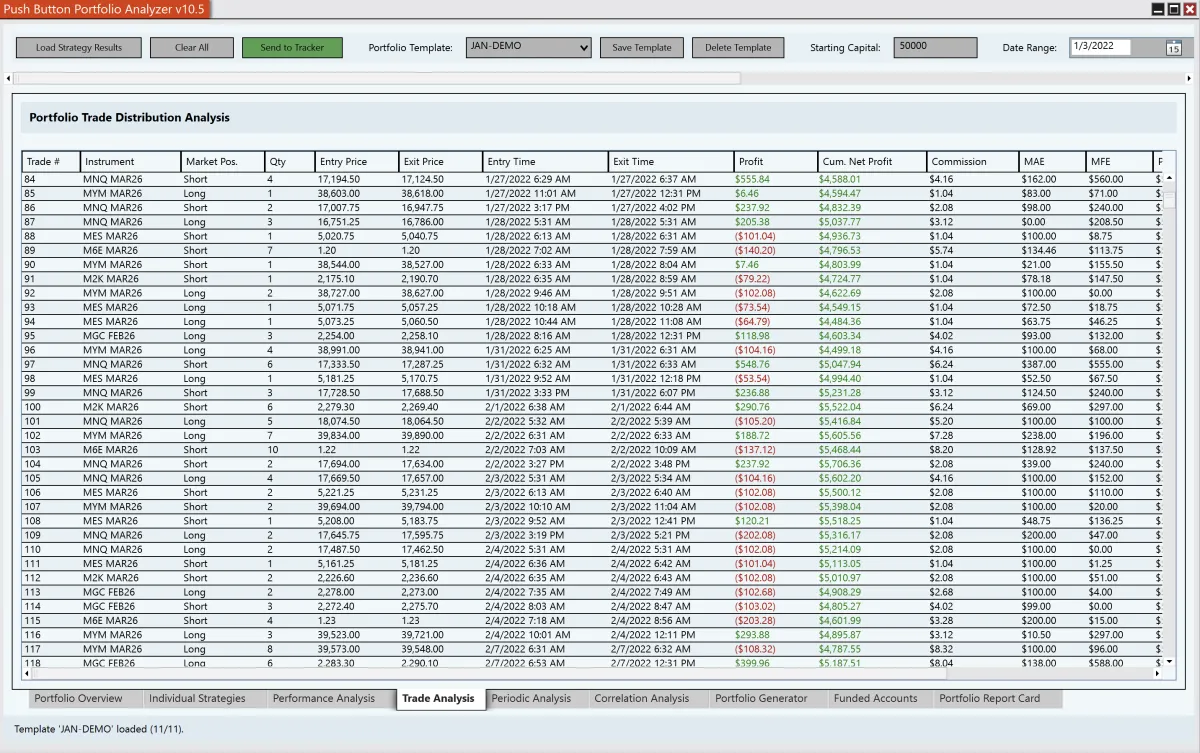

REVIEW TRADE LISTS

Trade Analysis

This screen shows every position across the portfolio with full transparency, including entries, exits, profit, commissions, and more. Traders can review execution all trades taken within the 4 year backtest window and validate that portfolio behavior stays within funded account rules before going live.

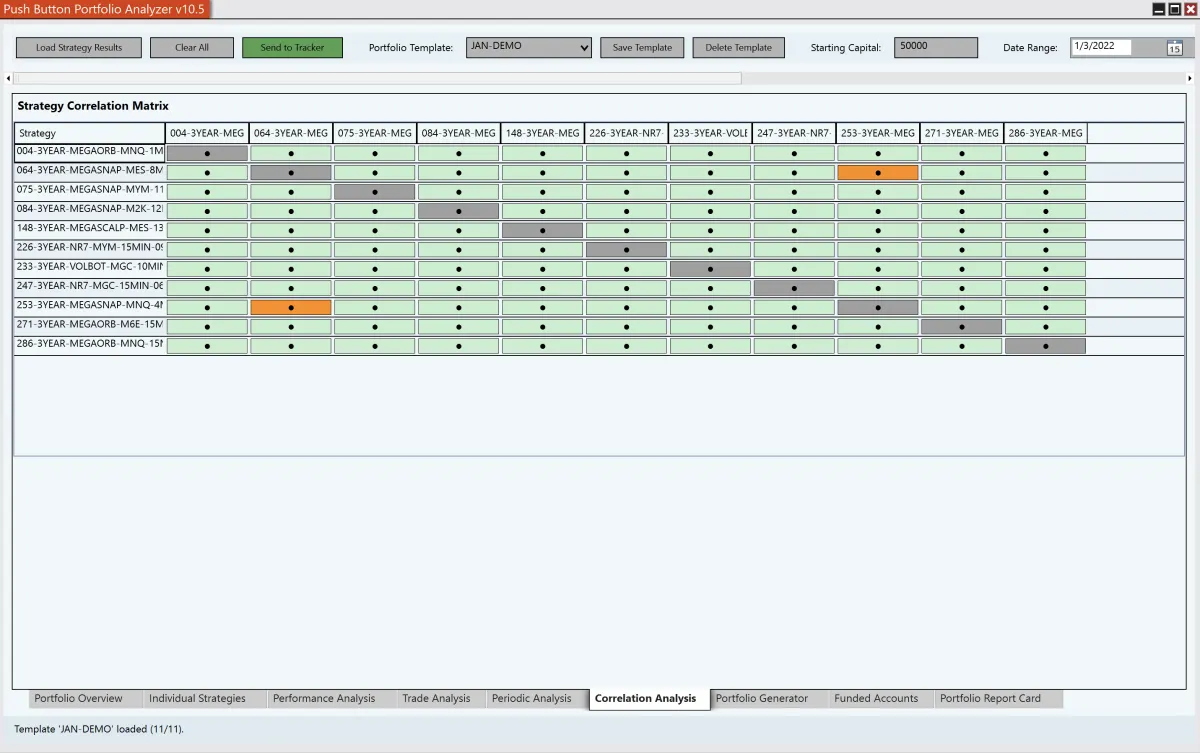

IDENTIFY HEDGING RULE CONFLICTS

Correlation Analysis

This screen shows how strategies interact, or more importantly overlap, helping traders identify diversification, and hidden risk across a bot portfolio. It makes it easy to build low-correlation, funded-account-friendly portfolios designed to trade within funded account "anti-hedging" rules.

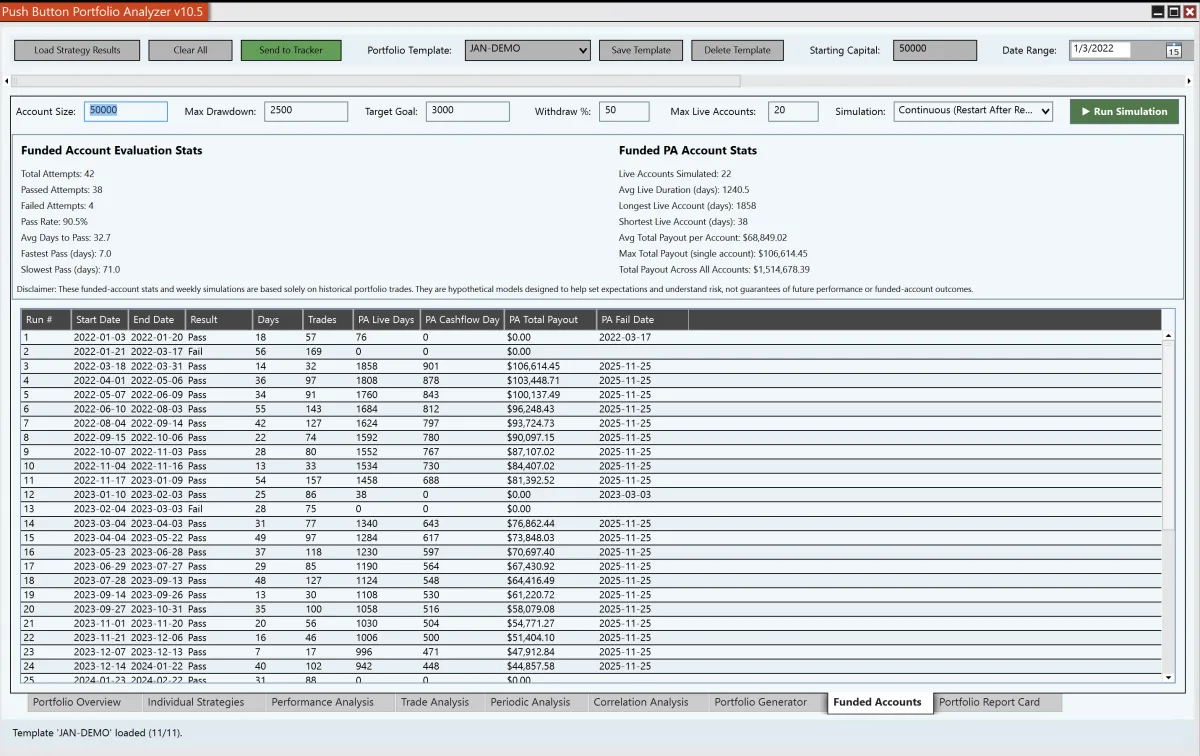

PASS RATE VS PAYOUT DOLLARS

Funded Accounts

This screen shows how a portfolio would have performed under real funded account rules, including pass rate, time to pass, and long-term payout potential. Traders can model evaluations, visualize scaling outcomes, and validate funded-account readiness using data-driven simulations before ever paying for an eval.

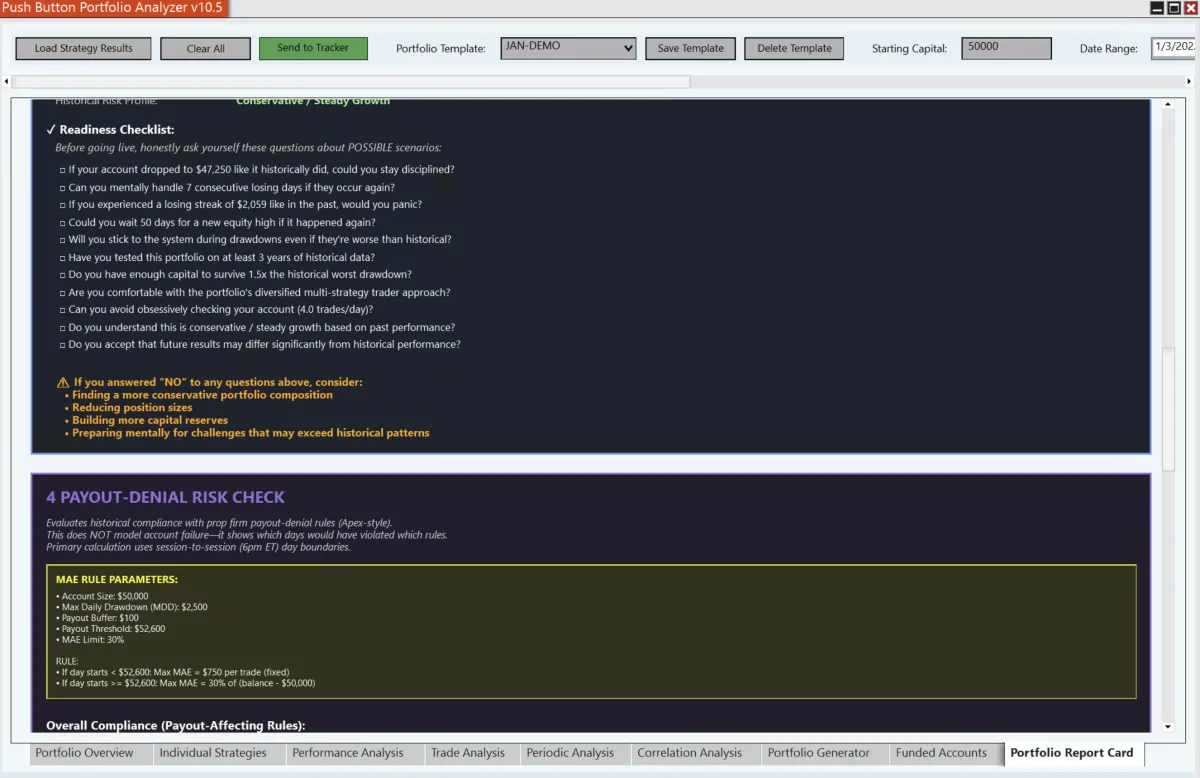

QUICK VIEW

Report Card

The Report Card is organized into 4 clear sections: portfolio composition, showing how your bots are allocated and working together; and a historical performance summary, breaking down returns, drawdowns, and consistency over time. It also sets behavioral expectations so you know what “normal” looks like during winning and losing periods, and includes a payout denial risk check to flag behaviors or settings that could violate funded-account rules before they become expensive mistakes.

NEW COMBINATIONS

Portfolio Generator

This view automatically builds and ranks bot combinations based on drawdown limits, monthly profit targets, and funded account constraints. Traders can instantly surface high-probability portfolios designed to meet evaluation rules, then save and deploy them with confidence.

© 2024 - 2026, Push Button Trading, All Rights Reserved

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonial Disclosure:

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Educational Disclosure:

The Push Button Trading mentorships, courses, classes, live events, and content are provided for educational purposes only. We are not providing financial advice. It is your responsibility to test all strategies and plans. You are the only one pushing the buttons and it is your responsibility to fully understand the risks before implementing any of the education provided by Push Button Trading.