12-MONTH MEMBERSHIP

Learn automated bot trading in a "small study group" of up to 15 students, taught live by an industry expert. You'll learn everything you need to set up, deploy, optimize, review and GO LIVE. Go from a total newbie to an experienced bot trader and run multiple bots and strategies on your desktop or in the cloud. During class, Matt shares his 5 favorite bots with you.

Elevate Your Trading Game

Join our exclusive year-long mentorship designed to turn your trading knowledge into consistent profits. You'll receive personalized coaching, access to cutting-edge trading bots, and hands-on guidance to master advanced strategies. Engage in monthly Zoom classes with your group, review recordings at your convenience, and tap into our online resources anytime. This mentorship is tailored to empower you with the skills and confidence needed to thrive in today’s markets.

Why Choose Us?

Expert Coaching: Direct access to experienced mentors.

Comprehensive Resources: Bot & report sharing, Q&A, and more

Tailored Strategies: Learn bot trading WITHOUT needing coding skills.

TOP QUESTIONS

Can I use the trading bots to help get a funded account unlocked?

Yes, our bots are designed to execute precise trading strategies that align with the requirements of many prop trading firms. Our technology allows you to automate your trading, giving you a better chance of reaching the goals set by these prop trading programs.

If the trading bots make the trades for me, why do I need a class?

Bots are sophisticated technology tools - you need to first understand how to back test & operate them.

The class empowers you to make informed decisions, ensuring that you're not just relying on automation but also enhancing your overall trading skills and knowledge.

Once class ends, will the bots still be available to use, how much support is there for questions, troubleshooting, etc?

Yes, as long as you're a member of the Premium Community, we provides new features and new versions of the bot technology, new bots, as well as LIVE weekly calls with Matt, which provides ongoing bot trading support.

I'm new to bots and prop trading, is there a learning curve? How soon will I see results and profits?

Yes, but it’s manageable with the right resources and support. Understanding how bots operate, setting up strategies, and grasping the fundamentals of prop trading all take some time and practice.

INCLUDES

1-SMALL GROUP ONLINE CLASS PER MONTH - Once a month, you'll meet online with your small group and coach for a 1 to 1.5-hour class via Zoom. These classes will occur on the same day each month and will be recorded, so you can review them as often as you like. During these hands-on classes, we’ll dive deep into the mechanics of our trading bots, providing you with a comprehensive understanding of trade entry, risk management, and strategy execution.

ONGOING SUPPORT, 12 MONTHS - For a full year, you'll have continuous access to your coach, ensuring personalized guidance and support as you apply what you've learned. In addition, your class's online space will be available for file sharing, Q&A classes, and a wealth of resources to enhance your learning experience. This ongoing support is designed to help you refine your skills, stay updated on new strategies, and remain connected with your learning community, giving you the tools and confidence to succeed in your trading journey.

TECHNOLOGY UPDATES, 12 MONTHS - For a full year, you'll have continuous access to updates and all the cutting-edge technology we're developing. Our newest trading bots, designed with enhanced features are regularly released, and you will receive these updates as they become available. As long as you remain a member in good standing, you'll stay up-to-date with the latest trading bot versions, ensuring you have access to the most advanced tools, giving you the tools and confidence to succeed in your trading journey.

5 BOTS / STRATEGIES - No coding required. Through detailed explanations and real-world examples, you’ll gain a deep understanding of how automated trading systems operate. We break down complex concepts into simple, actionable insights, allowing you to grasp the mechanics behind the strategies without needing a programming background. This approach empowers you to confidently apply these techniques in your own trading endeavors, whether you’re managing trades manually or utilizing automated tools, ultimately enhancing your ability to navigate the markets with precision and ease.

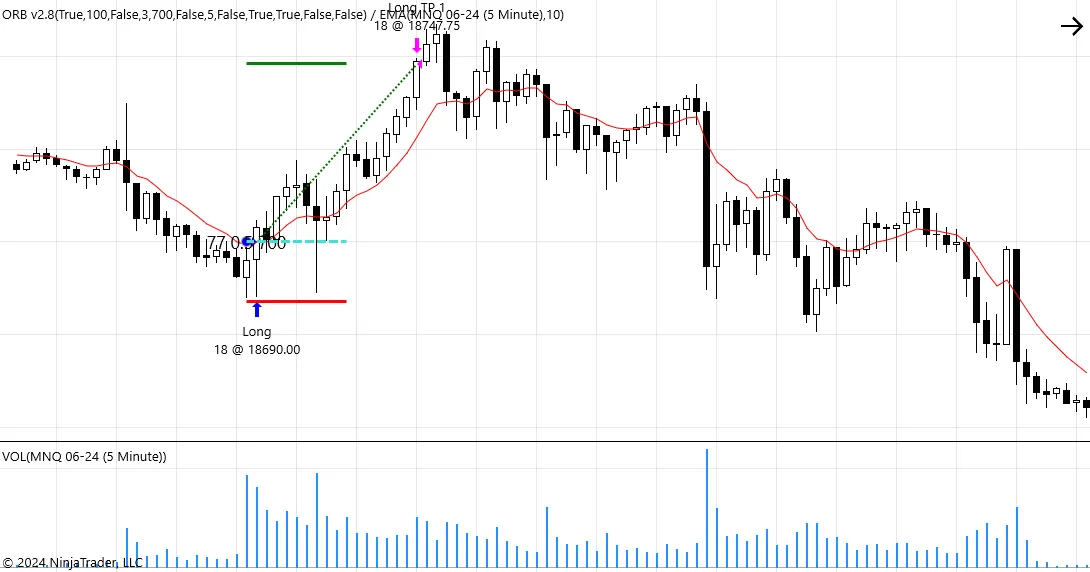

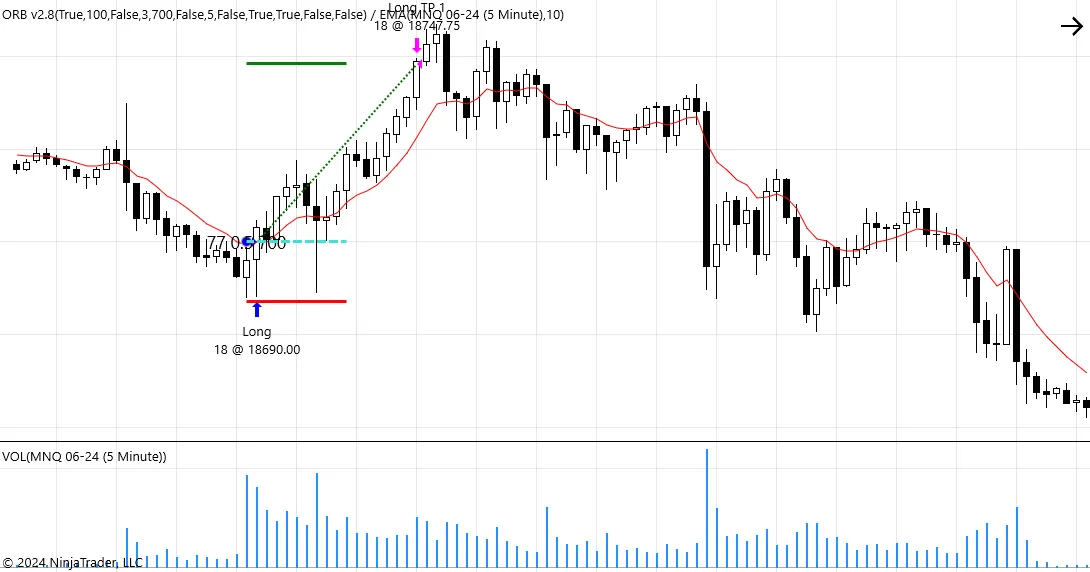

ORB BOT

SNAPBACK BOT

NR7 BOT

10EMA BOT

VOLUME BOT

IDEAL FOR

Budget-conscious individuals looking for an affordable way to get started with bot trading.

Aspiring traders looking for more consistency in their trading.

Those seeking a structured, year-long program that provides support throughout the year.

Traders who value an 80/20 focus on data driven decision making over technical analysis.

Busy individuals needing a flexible learning schedule that fits into their lives.

Students who appreciate guided direction and proper education, ensuring steady progress.

Traders who want ongoing access to a coach for additional support without committing to expensive one-on-one mentorship.

PUSH BUTTON STRATEGY

June 20, 2024 START

3rd Thursday EVERY Month

6:00pm EST

Any Level Welcome

HAMMER Strategy

with Tracy Ball

15 students MAX

"I was finally able to successfully fund a prop account. Previously, I struggled with consistency and often gave back my profits. In this class, Matt provides comprehensive knowledge and skills necessary to become a successful bot trader."

Timothy D

TOP BENEFITS

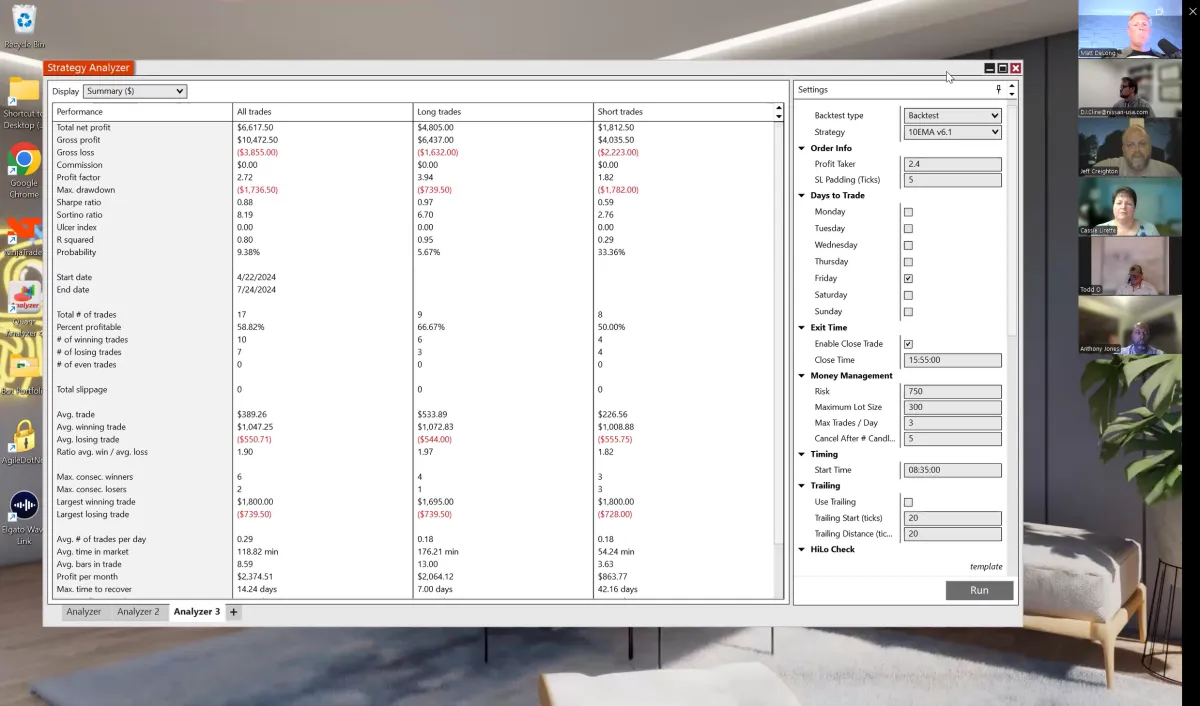

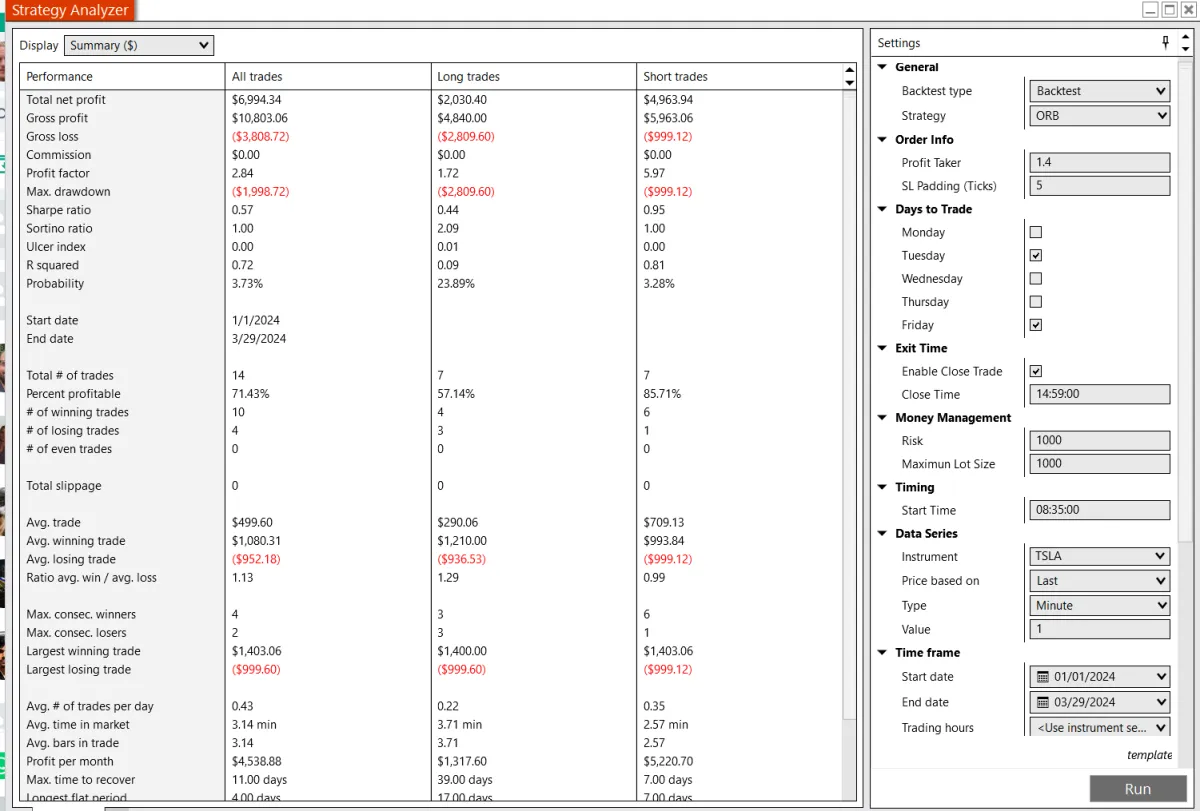

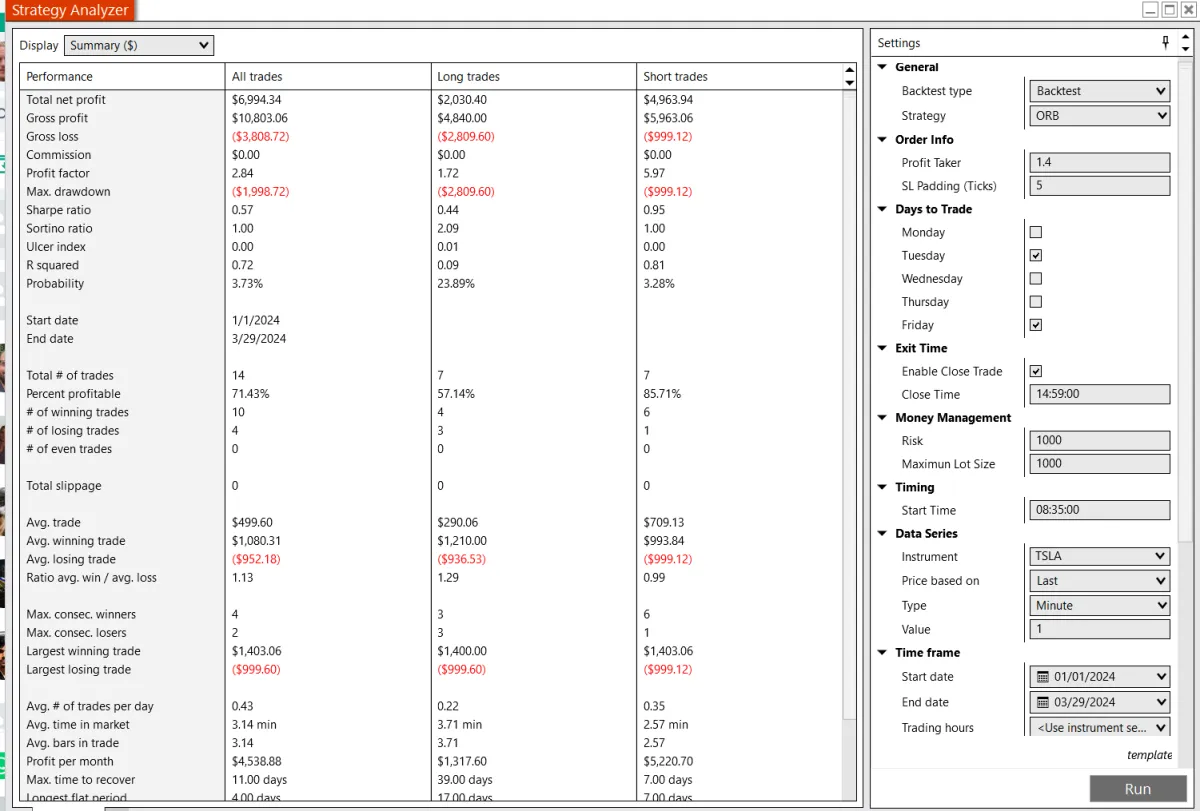

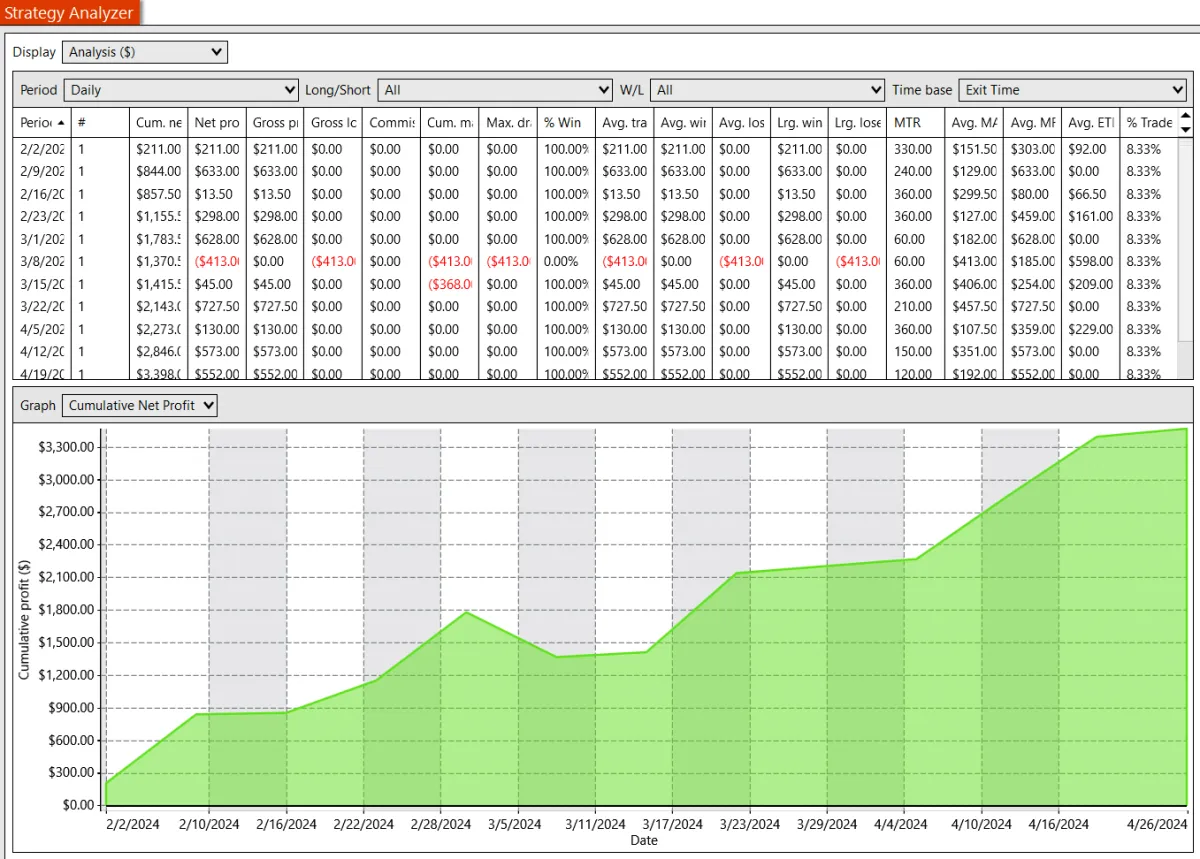

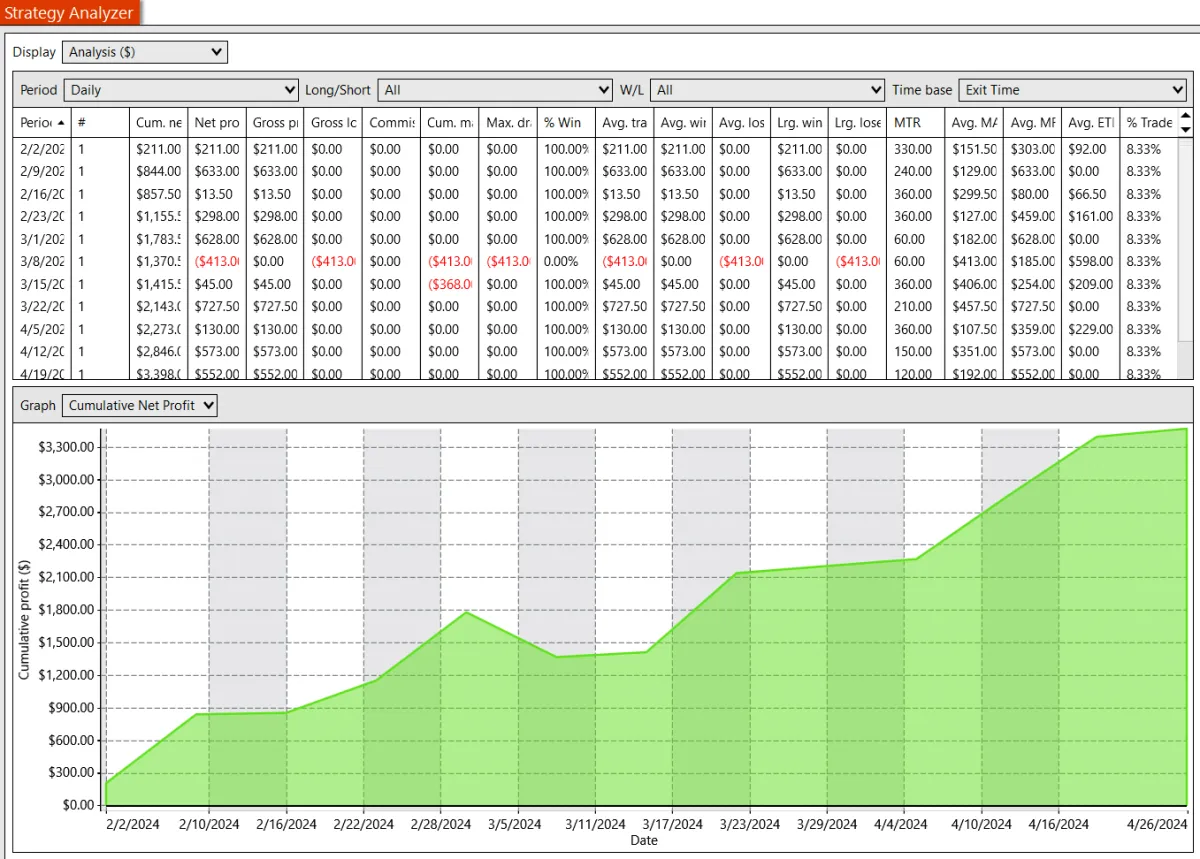

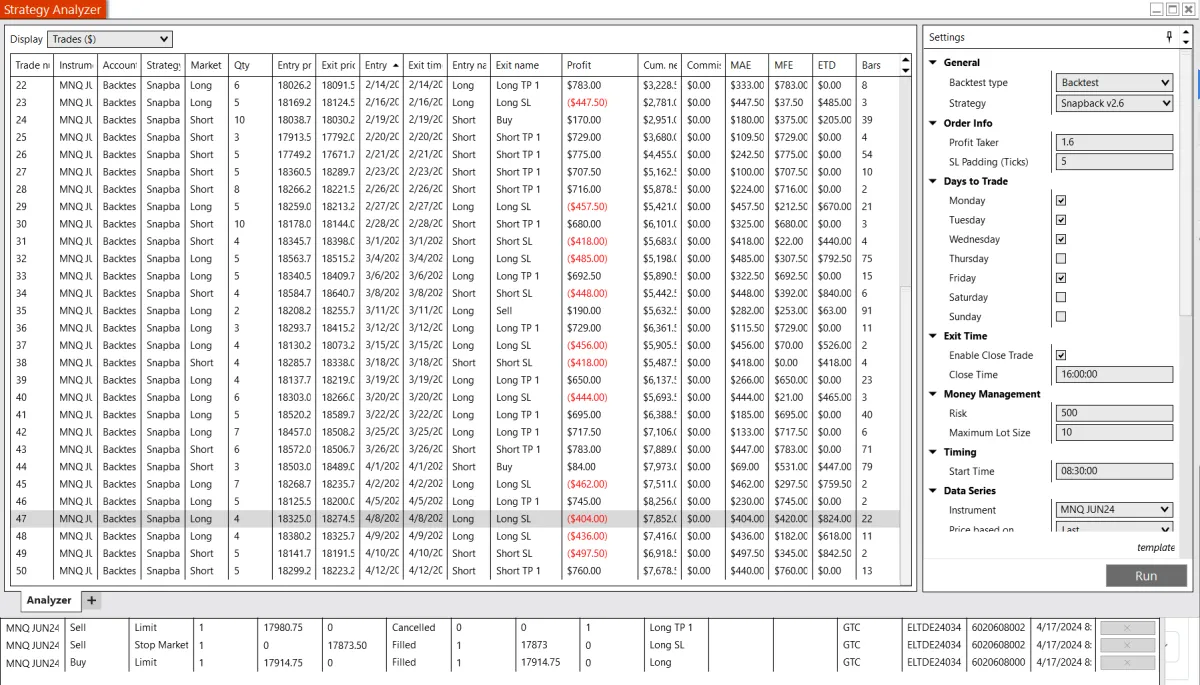

STRATEGY ANALYZER & AUTOMATED BACKTESTING - Explore past market conditions with our software to see how different bot strategies would have performed. Analyze historical data to refine your trading strategies.

DATA-DRIVEN DECISION MAKING - Leverage our software to review how various bot strategies would have worked in different market scenarios. Make informed decisions based on comprehensive historical analysis.

FULLY AUTOMATED BOT TRADING - Our advanced bot trading technology calculates order entries, stop losses, and target price levels in milliseconds. It executes trades with precision, adhering to your pre-defined risk settings. The bots autonomously manage entries, take profits, and stop losses based on your predefined parameters.

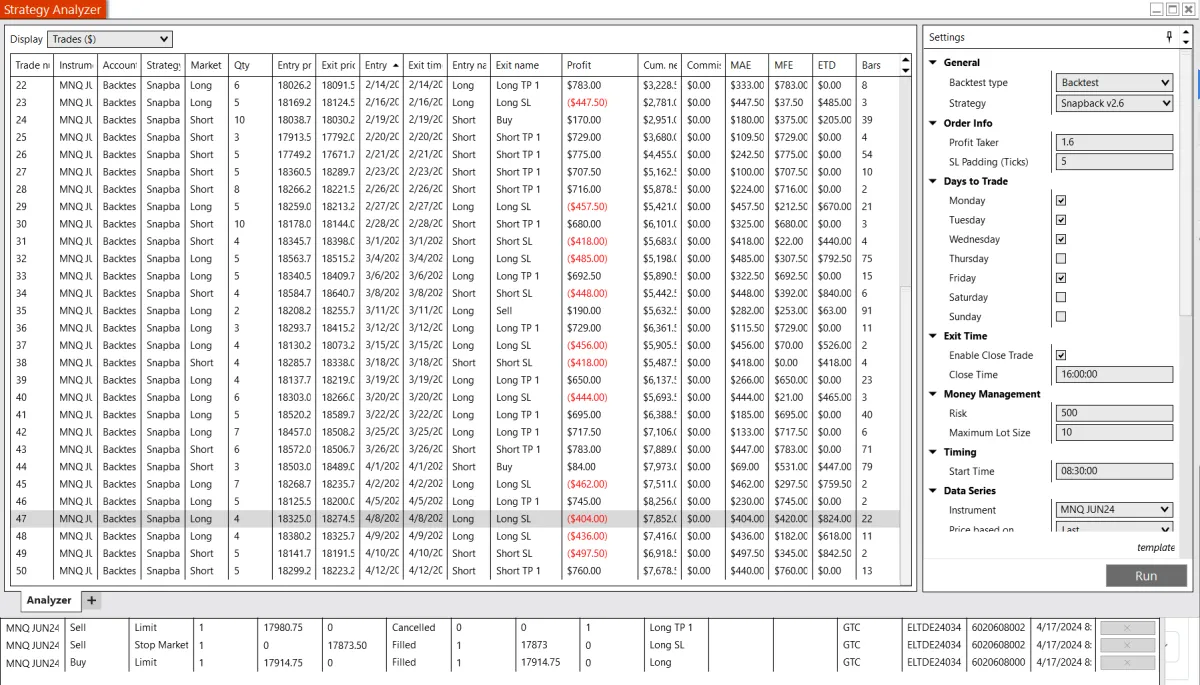

UNLOCK TRADING CAPITAL WITH FUNDED ACCOUNTS - Prop account trading allows you to leverage capital for larger positions. Achieving an 8-10% growth in your account showcases your trading skills. Our technology is compatible with various funding options, lowering the entry barrier and providing a lower-risk environment to hone your skills.

TRADE WITH TRADITIONAL BROKERS - Connect seamlessly with traditional brokers like TD Ameritrade or Interactive Brokers. Sync your trades for fully automated trading in both funded accounts and traditional brokerage accounts.

RECLAIM YOUR FREE TIME - Automating bot trading frees up your time, enabling you to pursue financial freedom for yourself and your loved ones. Our year-long mentorship program provides the flexibility to learn at your own pace and master the trading skills you need.

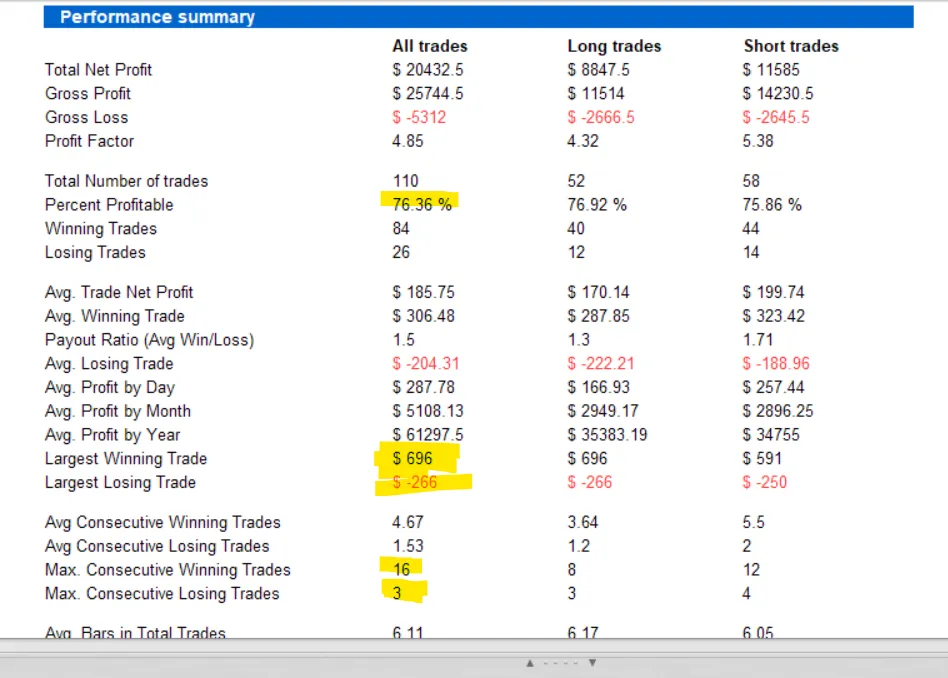

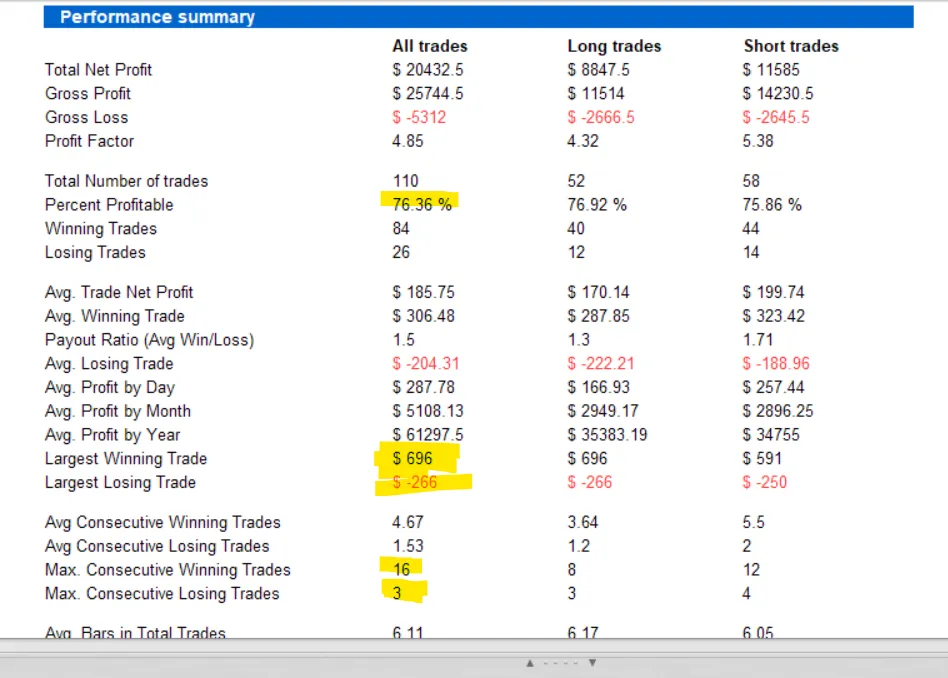

STATS

70%+

PERCENT

PROFITABLE

2.0+

PROFIT

FACTOR

4.0x

TOTAL NET PROFIT

VS MAX DRAWDOWN

<-5%

MAX

DRAWDOWN

Each bot is designed with a dozen+ settings that influence its effectiveness. These metrics represent the baseline targets we strive for during our automated backtesting process.

CLASS OUTLINE

Month 1 - Intro to Bot Trading Software

Get started with the Ninja Trader 8 bot trading software by downloading and installing it on your desktop / laptop. Learn how to connect it with multiple brokers for trading stocks, cryptocurrencies, futures, and more. Dive into the strategy analyzer to understand back testing and see how your strategies perform. Plus, import your first trading bot for day trading and run your first automated back test to see how it performs in different scenarios

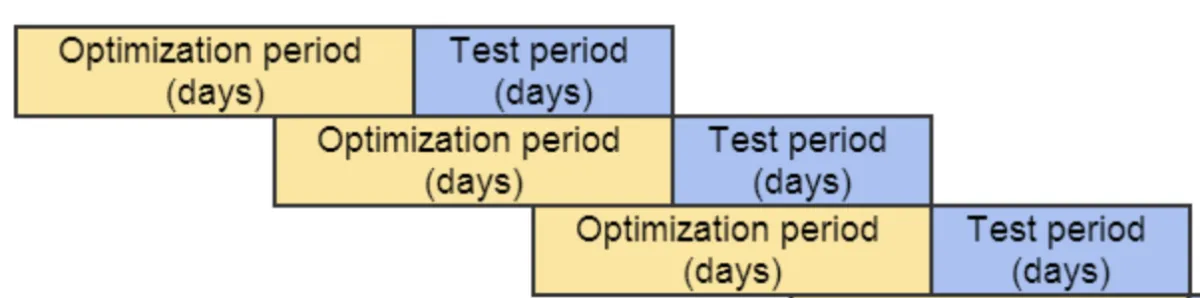

Month 2 - Bucket Testing Instruments

We take a closer look at the outcomes of your back tests by examining different elements like time zones, connections, and the specific days or times the bots are trading. Understand how to identify key trading signals and analyze different timeframes and data series. Learn to pinpoint your most successful strategies by using the 'profit factor' to separate the winners. Plus, get hands-on with bucket testing to see how changes might improve your results.

Month 3 - Optimization Testing

Discover how to optimize for risk, profit-taking, maximum lot size, stop-loss padding, entry padding, timeframes and more through day-of-the-week testing for single-day strategies. Learn to save and reload settings templates, identify backtest anomalies, and handle wildcard trades. Intro to bot 2 (day trading bot).

Month 4 - GO LIVE with bots on your Desktop Computer

Learn how to attach a bot to LIVE charts, configure GO LIVE, adjust settings, and use templates, along with a detailed checklist for going live and configuring LIVE accounts on your desktop/laptop. Our bot technology is compatible with traditional brokers like TD Ameritrade, Interactive Brokers, and dozens of funded account programs. In this class, we'll launch our first bots in practice accounts.

Month 5 - Combining Backtests

Review student backtests and provide a brief overview of the optimization testing process. Utilize templates for both backtests and optimizations to ensure consistency and efficiency. Discuss the process of updating bots with newer versions. Additionally, analyze the combined backtest process to evaluate portfolio-level performance across multiple combined backtests using 3rd party tools.

Month 6 - GO LIVE with bots in the cloud using VPS

Learn how to setup a VPS to run your bots in the cloud, attach a bot to LIVE charts, configure GO LIVE, adjust settings, and use templates, along with a detailed checklist for configuring LIVE accounts in the cloud. In this class, we'll launch our first bots in practice accounts, but in the cloud vs your desktop.

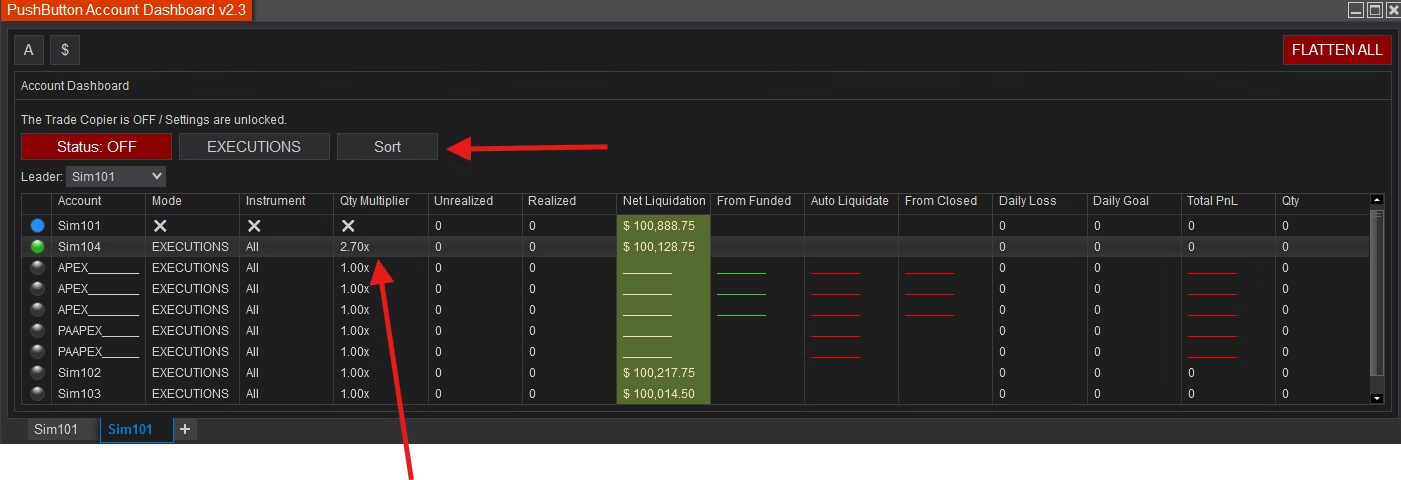

Month 7 - Parallel Testing and End of Week Test Reviews

Learn how to review live trades versus backtest trades from the previous week, focusing on single-day bots with different configurations for each day. Compare parallel test results of backtests versus live trades, and discuss when to let the bots continue and when to adjust them. Additionally, we explore bot 3 hybrid day trading and swing trading bot.

Month 8 - Account Dashboard and Trade Copier

Our powerful Account Dashboard/Trade Copier, which allows seamless copying of market or exact orders across unlimited accounts, including funded, personal, or simulated accounts. It features built-in risk management to protect your capital and provides key insights such as account balances and progress toward full funding. Offered at a fraction of the cost of similar tools, it's designed to help you stay informed, in control, and ahead in your trading.

Month 9 - Forward Testing

Unlike backtesting, which uses historical data to assess a strategy's potential, forward testing involves applying the algorithm to real-time or simulated market conditions. This approach allows traders to observe how the bot performs in a live environment before committing actual capital. By analyzing forward testing results, traders can fine-tune their algorithms, adjust parameters, and ensure robust performance under dynamic market conditions. This iterative process enhances the bot's reliability and adaptability, crucial factors in achieving consistent profitability in automated trading strategies and intro to bot 4.

Month 10 - Bot Trading Psychology & Expectations

In this class, we delve into the common challenges traders encounter when launching automated bots for trading. We discuss strategies to sidestep potential pitfalls, emphasizing realistic expectations in the realm of bot trading. By exploring these issues comprehensively, participants gain insights into optimizing bot performance while navigating the complexities of financial markets effectively. Intro to bot 5, the most complex of them all and a community favorite.

Month 11 - Trading Plan Finalization

You've had time to log the hours and trades in the simulated environment. You've been building confidence and optimizing your plan. It's time to add the final polish and transition into live trading with a funded account. Begin trading during the live market hours but with a paper trading (fake money) account. If you're ready, you may have already begun trading an assessment account for a funded account. Let's review some of the trades, getting feedback.

Month 12 - Final Review + Stats

We conduct a final review of the start to finish process for evaluating a new bot, starting with bucket testing, optimization, settings file templates, and report exports. We will cover going live and building your plans for the upcoming month, along with tips to keep all your back tests, settings, and bots organized.

PUSH BUTTON STRATEGY

June 20, 2024 START

3rd Thursday EVERY Month

6:00pm EST

Any Level Welcome

HAMMER Strategy

with Tracy Ball

15 students MAX

"Having a full-time job on the east coast makes it's difficult for me to actually trade markets the way I would like to. Now I rely on the bots to do it for me."

JOHN W

WHAT STUDENTS ARE SAYING

I want to share my awesome experience with the BOT trading class I recently completed with Matt. If you’re looking to boost your trading skills, this class is a must! Matt is not only super knowledgeable, but also incredibly passionate about teaching. He made sure we really understand the material and could use it to improve our trading strategies. This class didn’t just improve my skills, it also created a wonderful, supportive learning community. Highly recommended!

- Nima S

★★★★★

Thanks Matt. I can't recommend your training too much.

It's utterly shifted my mindset towards trading. Van Tharp (Market Wizards 1) always said "Develop a trading system that's right for you.

I've been looking for this for a long time.

- Bruce D

★★★★★

Just a shout out regarding Matt’s automated bot trading class. This is the second time I took it and I needed it, previously I’ve struggled to get it all together. This review got me to take a look at how I was back-testing and how I was evaluating my results. I realize that it did not really know how to identify what a good bot setup was. All in all, I highly recommend that if you are considering taking the class, DO IT!

- Larry B

★★★★★

Just completed the Bot Trading Class with Matt DeLong. The information presented was great and if you are a person who struggles with decision making or influenced by emotions, i highly recommend you consider the Bots. Being an analytical person, this approach to trading is what I believe i need to have any semblance of success and Matt was great at conveying the diligent approach to managing the technology.

- Paige W

★★★★★

Another great bot class with Matt DeLong. I have had the good fortune of participating in several of his bot classes over the years. I learn new things with every class. If you have not taken a bot class with him, bot trading is not nearly as intimidating as it may sound.

- Harold C

★★★★★

It's quite surreal, I've only investing $500 of my own funds in funded accounts and it just returned me $6,000. I can't think you and your team enough for your training and bots.

- Shawn B

★★★★★

I recently completed the course for the second time as well. If you’re considering taking the class, I highly recommend it. After a year and a half of struggling previously, I was finally able to successfully fund a prop account. Previously, I struggled with consistency and often gave back my profits. In this class, Matt provides comprehensive knowledge and skills necessary to become a successful bot trader. You will learn how to effectively manage and optimize bots as well as test various strategies to identify the most effective ones. In my opinion, this is the best approach to trading and I have no desire to return to manual trading. Furthermore, I expressed my deepest gratitude to Matt and team for their efforts and thank you so much.

- Timothy D

★★★★★

I just finished my bot class, and I am so glad I went ahead and took it! I’ve taken plenty of online courses and this one is head and shoulders above the rest. The small class size really encourages participation and you have no choice but to make progress while in the course. And the icing on the cake is that the course never really ends in the premium community, we still have weekly calls for support and an amazing engaged community. I’m working on getting a $250k account funded right now and I know I’ll get there.. I have no choice but to get there with the support of this community.

- Alicia M

★★★★★

I recently completed the fully automated bot trading class, it’s awesome! Having a full-time job on the east coast makes it very difficult for me to actually trade markets the way I would like to. Now I can rely on the bots to do it for me, all I need to do is little homework on the weekend to make sure they are behaving the way I want them to. It’s all highly beneficial for my trading psychology, relying on the past back testing to predict the future. I can’t recommend this course.

- John W

★★★★★

FREQUENTLY ASKED QUESTIONS

CLASS INFO

Can I use bots to help get a funded account unlocked?

Yes, that is one of the top reasons traders use the bots, in addition to the time freedom.

If trading bots make trades for me, why do I need to take a class?

Bots are sophisticated technology, you need to understand how to test & operate them.

What happens if I miss a class, is it recorded?

Yes, every class is recorded and sent out to each student. If you miss a class you will be able to go back and watch the entire session

What if I want to take more than one 12-month mentorship at a time?

You only get access to one mentorship at a time PER membership. Want to have two mentorships going at the same time? Pay for TWO memberships. It's that simple. Instead of $150/month, you would pay $300/month.

Do I need an prop firm / assessment account for this class?

No you don't, but it's highly recommned, you will need a data package in order to test the bots in a simulated environment as you're learning. Having a low cost prop account would provide the data needed and an option to work towards getting funded.

I don't want to wait an entire year to get the education.

We have an on-demand training course that offers a similar education, but it's pre-recorded, includes access to our BASIC bot community and you take it at your own pace and includes 60-days of premium community access.

BOT INFO

Are the bots for me if I have no experience trading?

We have had plenty of people who have never placed a trade in their life sign up for the bots course. Some extra knowledge on trading wouldn't hurt, but is not necessarily required.

What OS / platform do the trading bots work with?

The bots operate within our preferred trading software, NinjaTrader 8, which is compatible on Windows-only operating systems. If you use a Mac OS, you can install Parallels to install on a Mac. More about our recommended trading software.

Can you provide a video of the trading bots in action?

The playlist demonstrating how the ORB, Snapback VolumeBot, 10ema and NR7 bots operate are embedded in the videos about 1/3 of the way up this page.

What is the win rate of the bots?

It is difficult to say the failure to success rate of the bots since you are the one deciding what to run them on. Each bot has about a dozen different settings. Matt will show you how to think through which settings to use. Ultimately you will be making the decisions on what you want to run each bot on based on back test results.

What size account do the bots work on?

It works on any account size. Each trading bot comes with customizable settings, allowing you to easily adjust parameters such as risk level based on your account size.

Can I use the bots with any broker?

The tool lives inside the NinjaTrader8 software platform and operates in that environment, however NinjaTrader8 supports both traditional brokers (like TD Ameritrade and Interactive Brokers) as well as dozens of prop firms for funded account trading. The asset you can trade depends on the broker selected.

How many bots do we get in class?

In class, we go over about 5 different bots and spend time on each one explaining how the bot works, how the strategy is executed, and related homework so we can talk about it the next class. Matt shows you how to use all of the tools during class.

How much are the bots without the classes?

The bots are only offered through a mentorship program, which includes training on setup, optimization, and live trading. The classes are an integral part of gaining access to the bots, as the focus is on learning and using these tools within a structured program. We don't sell the bots directly without the training component.

PUSH BUTTON STRATEGY

June 20, 2024 START

3rd Thursday EVERY Month

6:00pm EST

Any Level Welcome

HAMMER Strategy

with Tracy Ball

15 students MAX

12-MONTH MEMBERSHIP

BOT TRADING AUTOMATION

STARTING JANUARY 22, 2025

4th Wednesday of EVERY Month

8:00pm EST / 7:00pm CST

5 bots / strategies included

Questions? Book a call

MATT DELONG

FAST TRACK

ON DEMAND SELF STUDY COURSE

We offer an "on-demand" self-study version of the class that includes the 5 bots we review in class, on-demand recordings of our 4-week classes, access to the LIVE 12 month classes as well as 12 months of premium community support.

8 recordings, 5 bots, 12 LIVE classes, 12 months support

TECHNOLOGY, EDUCATION, COMMUNITY